Litigation funding in the realm of intellectual property has existed in the United States for several decades. This type of funding is now making its way onto the European continent.

The dispute between VLSI Technology and Intel stands as one of the most significant recent patent litigations. In 2021, a jury in Austin, Texas, awarded damages of USD 2.175 billion against Intel for infringing two U.S. patents. In reality, this litigation had been financed by Fortress Investment Group, a private investment firm managing over USD 50 billion in investments, along with its investors.

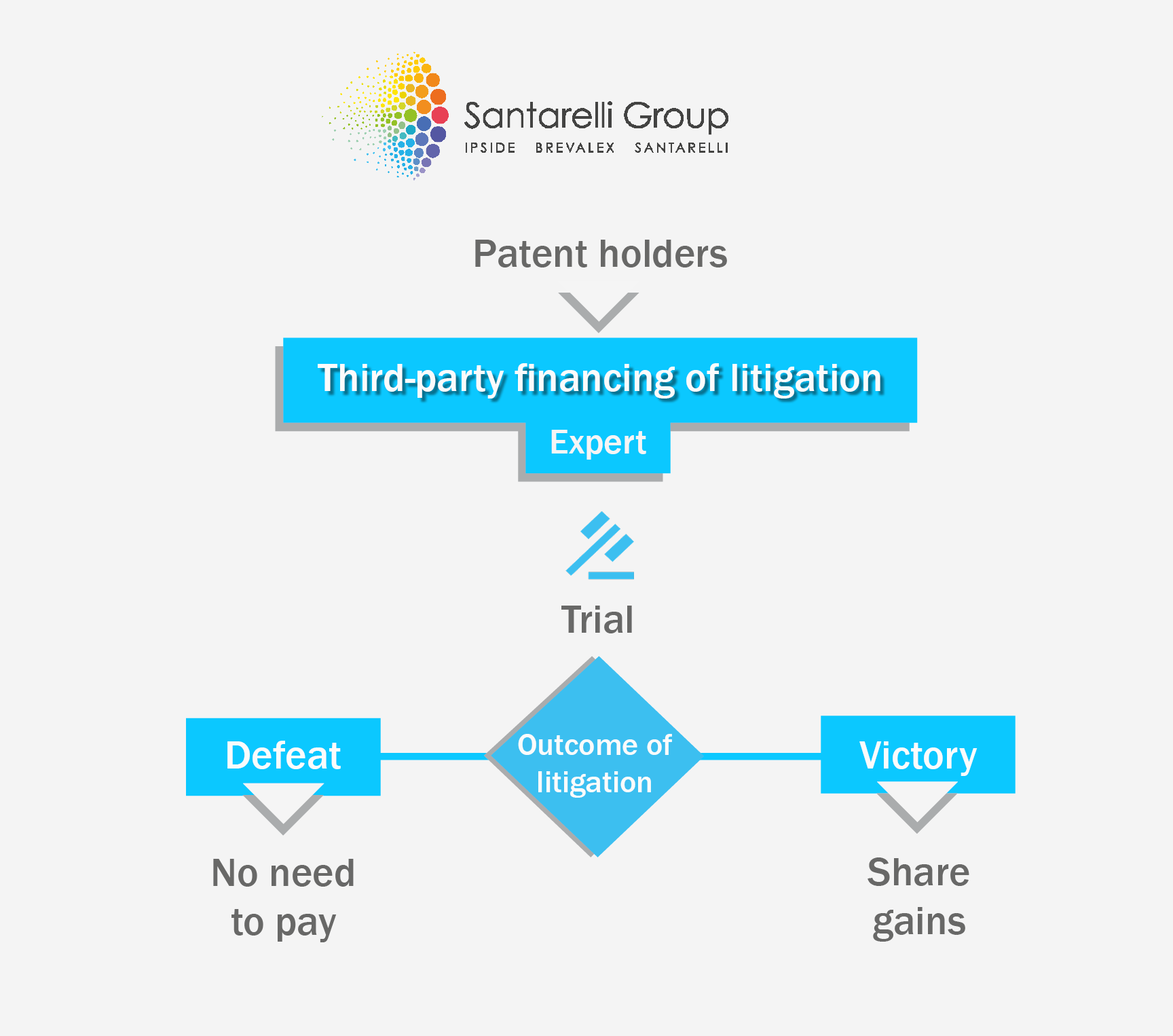

Litigation funding in intellectual property matters is a form of third-party financing that provides financial assistance to plaintiffs in intellectual property lawsuits. It is typically used to cover litigation costs, such as attorney fees, expert fees, and court expenses.

Litigation funding in intellectual property matters is commonly structured as a non-recourse loan, meaning that the plaintiff is not obligated to repay the loan if they lose the case. However, if the plaintiff prevails in the lawsuit, the investor is entitled to a percentage of the damages awarded.

Intellectual property litigation funding can be a valuable tool for plaintiffs with meritorious intellectual property claims but lacking the financial resources to pursue them. It can also serve as a means for plaintiffs to mitigate litigation risk by transferring a portion of the financial burden to the investor.

Below, we provide an example of how intellectual property litigation funding operates:

- A company holds a patent for a new technology. A competitor begins using this technology without authorization, thereby infringing the company's patent.

- The company wishes to sue the competitor for patent infringement but lacks the financial resources to cover the costs of litigation.

- The company approaches an intellectual property litigation funding company for financing.

- The intellectual property litigation funding company reviews the company's patent and evidence of infringement.

- If the intellectual property litigation funding company deems the case to be meritorious, it agrees to fund the company's litigation.

- The intellectual property litigation funding company and the company enter into a funding agreement that outlines the terms of the loan, including the interest rate and the percentage of damages that the intellectual property litigation funding company will receive if the company prevails in the lawsuit.

- The intellectual property litigation funding company then advances the necessary funds to the company to cover the costs of litigation.

- The company proceeds with its patent infringement action.

- If the company wins the case, the defendant will be ordered to pay damages. The company then repays the intellectual property litigation funding company the amount of the loan, plus interest. It also pays the agreed-upon percentage of damages.

In France, the amount of damages in infringement cases is limited to the actual harm suffered by the intellectual property rights holder, following the principle of "All the harm. Nothing but the harm." This is without loss or profit to the holder. This is now changing with the entry into force of the Unified Patent Court (UPC), which opened its doors in June 2023. With the UPC, the amount of damages will extend beyond mere harm, and some investors may be inclined to finance patent litigation in Europe.